Young buyers in any generation have a hard time buying homes because they tend to earn less, and have less in savings or existing equity than older buyers. However, the analysis found that in the Tulsa metro area, 17.0% of Gen Z householders own their home, compared to 15.0% nationally.

But Gen Z—the population of Americans born between 1997 and 2012—faces even greater challenges: student debt, increasing rents, and unprecedented growth in home prices have put homeownership further out of reach. Market conditions have the largest impact on where Gen Z is able to buy homes, with more affordable locations being more likely to have higher numbers of young homeowners. To determine the locations with the highest Gen Z homeownership rate, researchers calculated the homeownership rate for householders aged 15–24 in 2020 and ranked metros accordingly.

Gen Z and younger Millennials in some ways face even greater challenges. The explosion of student debt and increasing rents over the last decade have stretched budgets even further, making it more difficult to save, and rising home prices have put even starter homes further out of reach. Only around 34% of adults aged 20 to 34 own homes today, compared to 44% in 1960.

Young buyers also face competition in the market from older generations. Millennials (ages 26 to 41) are now America’s largest generation by population and make up 37% of all U.S. homebuyers. Generation X (aged 42 to 57) is smaller in size but its members are in their peak earning years, giving them more financial resources to buy homes. And older Americans in the Baby Boomer and Silent Generations are increasingly choosing to age in place, which has constrained the supply of homes available for younger buyers.

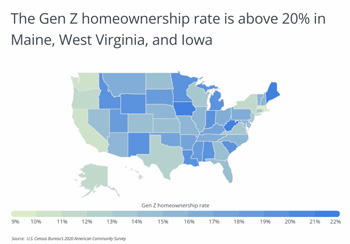

Young people’s changing social and economic norms have also delayed other major life milestones like marriage and childrearing, but there appears to be some evidence that places where people get married younger also have more young people who own homes. States where the typical age for a first marriage is older have some of the lowest rates of Gen Z homeownership, while states where marriage happens earlier have higher rates. Part of this may be simply financial, as a household with combined incomes will have more means to buy a home, and part of it may be lifestyle-related, as a married couple would be more inclined to put down roots in a location.

But unsurprisingly, market conditions have the largest impact on where Gen Z is able to buy homes, with more affordable locations being more likely to have higher numbers of young homeowners. Of the top 10 states for Gen Z homeownership, eight have median home prices below $300,000, according to the Zillow Home Value Index. States with higher real estate prices, like Massachusetts, California, and Washington, have the lowest share of Gen Z homeowners.

The analysis found that in the Tulsa metro area, 17.0% of Gen Z householders own their home, compared to 15.0% nationally. Here is a summary of the data for the Tulsa, OK metro area:

- Gen Z homeownership rate: 17.0%

- Median home price: $199,955

- Total Gen Z owner-occupied households: 2,854

- Total Gen Z renter-occupied households: 13,894

For reference, here are the statistics for the entire United States:

- Gen Z homeownership rate: 15.0%

- Median home price: $337,560

- Total Gen Z owner-occupied households: 665,529

- Total Gen Z renter-occupied households: 3,777,531

For more information, a detailed methodology, and complete results, you can find the original report on Porch’s website: https://porch.com/advice/cities-with-highest-gen-z-homeownership-rate.